Tax Refund Casino Losses

More Articles

- Tax Refund Casino Losses Payout

- Tax Refund Casino Losses Winnings

- Tax Refund Casino Losses 2019

- Tax Refund Casino Losses No Deposit

- Tax Refund Gambling Losses

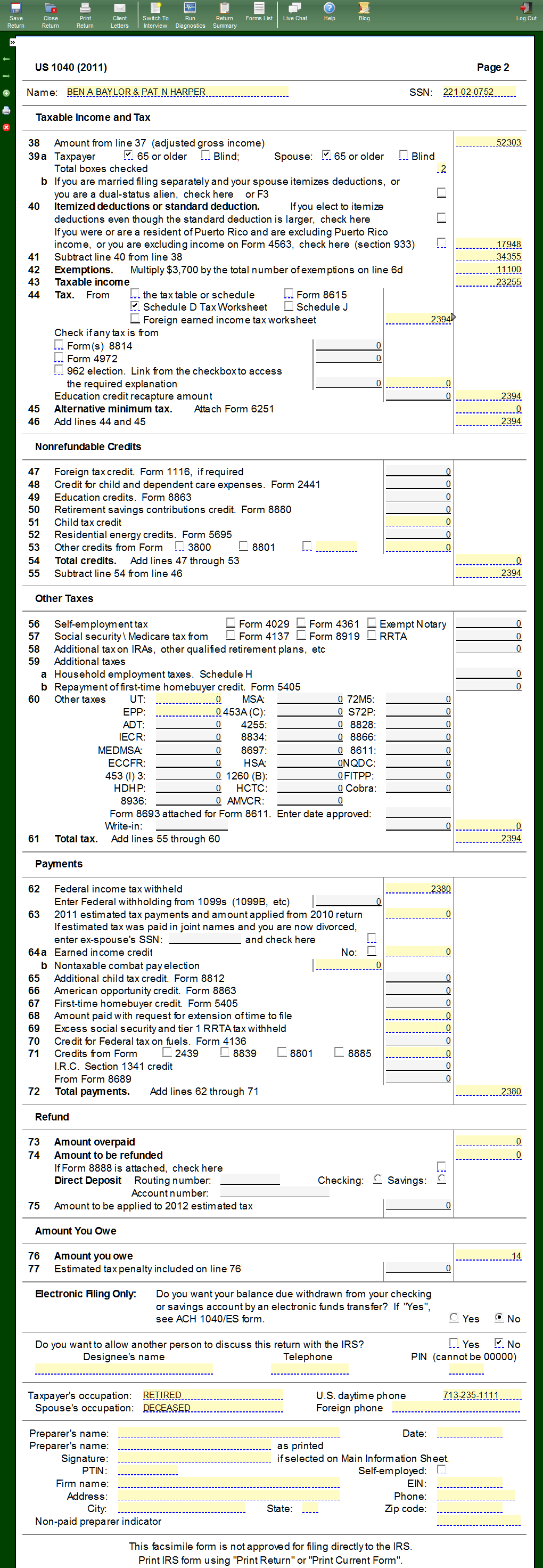

Find out how the new tax law has broadened the definition of gambling losses so that you can make the proper deductions on your 2018 return. The Tax Cuts and Jobs Act (TCJA) eliminates or scales back certain itemized deductions, including the deduction for miscellaneous expenses subject to the flo. You must list each individually, with the winnings noted on your return as taxable income and the loss as an itemized deduction in Schedule A. In this instance, you won’t owe tax on your winnings because your total loss is greater than your total win by $2,000. However, you do not get to deduct that net $2,000 loss, only the first $6,000. Limitations on loss deductions The amount of gambling losses you can deduct can never exceed the winnings you report as income. For example, if you have $5,000 in winnings but $8,000 in losses, your deduction is limited to $5,000. You could not write off the remaining $3,000, or carry it forward to future years.

If you had a successful night at the slots or poker tables, you're going to have to share some of the lucky proceeds with Uncle Sam. The Internal Revenue Service generally requires that you report your gambling winnings and losses separately when you file your taxes rather than combining the two amounts.

Record Keeping

As you gamble during the year, you need to keep records of your winnings and losses so that you can support whatever figures you report on your taxes. The IRS permits you to use per-session recording, which means that instead of recording whether you won or lost each time you pull the slot machine, you can simply record your total for the session. Your records should include the date and type of gambling, where you gambled and if you gambled with anyone else, such as a home poker game. If you win more than $600, you should receive a Form W-2G from the casino.

Taxable Winnings

When figuring your gambling winnings, only include the winnings from each session rather than using losses to offset your gains. You have to include gambling winnings even if you didn't receive a Form W-2G from the casino. For example, if you gambled six times during the year, winning $100, $3,000, $4,000 and $6,000 but losing $5,000 and $2,000, your gambling winnings for the year are $13,100. This amount gets reported on line 21 of your Form 1040 tax return.

Gambling Losses

To claim your gambling losses, you have to itemize your deductions. Gambling losses are a miscellaneous deduction, but -- unlike some other miscellaneous deductions -- you can deduct the entire loss. The deduction goes on line 28 of Schedule A and you have to note that the deduction is for gambling losses. For example, if you lost $5,000 on one occasion and $7,000 on another, your total deduction is $12,000.

Gambling Loss Limitation

You can't deduct more in gambling losses than you have in gambling winnings for the year. For example, suppose you reported $13,000 in gambling winnings on Line 21 of Form 1040. Even if you lost $100,000 that year, your gambling loss deduction is limited to $13,000. Worse, you aren't allowed to carry forward the excess, so if you had $87,000 in losses you couldn't deduct last year, you can't use that to offset the gambling income from the current year.

Tax Refund Casino Losses Payout

- tax forms image by Chad McDermott from Fotolia.com

Read More:

Tips for Claiming Tax Back from US Casino Winnings

You won big in Las Vegas, Atlantic City, Reno, or one of the other gaming destinations in the U.S. Once you win a jackpot, you’re faced with a very unpleasant revelation: you are immediately taxed on your winnings. However, Refund Management Services advises that there is a way to get all or a portion of your taxes back from the IRS.

You can win a lot of money gambling in the United States. Of course, that means you’re also subjected to a casino winnings tax.

If you’ve made a trip to the U.S. and your gaming winnings are high enough or you win a prize and take the cash equivalent, the IRS will deduct 30% off of your winnings. Nobody wants Uncle Sam to withhold their winnings.

Still, there’s no reason to avoid the gaming tournaments or slots when you’re south of the border. Here is what you need to know about before you travel to the US to gamble and how to claim and get tax back from us casino winnings.

- Once your US casino winnings pass a certain threshold (which differs by casino, but is often $1,199) you will be subject to withholding tax. When this happens, you will be issued a W2-G or 1042-S slip.

- Don’t wait more than three years to claim gaming winnings on a tax return; that said, if you’ve won in the current year, we will be filing a claim at the beginning of the next calendar year. Most of our customers typically contact us within a few days of returning to Canada or their country of origin, so we can begin preparing the paperwork for them to get the refund that is rightfully theirs. If you delay submitting your claim, you won’t be entitled to a refund after 3 years.

- Keep track of all your US wins and losses every time you go, reporting your losses will maximize your return.

- It’s not just US casino winnings that are taxed, other gaming activities can be taxed like lotteries, raffles, and races.

- Remember that you can also claim taxed gaming winnings on a variety of games, such as lotteries, raffles, and horse races.

- When it comes to getting tax back from US casino winnings, you have a few options:

How To Get Tax Back From US Casino Winnings

Nearly four million gamblers win big in gambling cities across the U.S. and the IRS deducts taxes from all of them. However, as a non-resident of the U.S., there is a way to get your casino winnings back from the U.S. by hiring Refund Management Services to go through the process of obtaining a casino winning tax refund from the IRS. RMS is the easiest way to get your money back.

If you win $1,199.00 or more, contact Refund Management Services and we will obtain your taxed gaming winnings by filing a tax return. Take the stress out of the process by letting our trained experts handle it for you!

At the end of the day you have two options:

Option 1: Claim Tax Back from US Casino Winnings On Your Own

It is possible to file your own withholding tax return. While this may save you a small amount of money, it is only advised if you feel confident in your withholding tax filing skills. Much like your annual tax return, with so many opportunities to leave money on the table or make costly mistakes, claiming tax back from US casino winnings on your own can leave you in a costly position. Every year we deal with clients who have been denied their withholding tax refund by the IRS after filing independently. It is complicated, time consuming, and expensive to appeal this decision, so it’s often not worth the risk.

Option 2: Use a Withholding Tax Refund Professional

These folks make it their business to get your tax back from US casino winnings. Although there is a fee associated to using a withholding tax professional, they will ensure you don’t make any costly mistakes. To make sure you make the right choice, look for the following in your withholding tax professional:

1. Relationships with Casinos & Gaming establishments:

Tax Refund Casino Losses Winnings

To start your claim process, you will need the IRS form 1042 from the casino you were playing in. If you misplaced it, that won’t be a problem for a reputable withholding tax refund professional since their relationship will allow them to easily recover it from the casino you were playing in. Even if you haven’t misplaced your form 1042, this is still a good quality to look for in your withholding tax refund professional.

2. Honest About Your Refund Timing

Tax Refund Casino Losses 2019

Although speed is of the essence when you’re looking to get your refund, due to the IRS wait times it is important to know that you’ll be waiting 6 months at a minimum but usually a full year before receiving your US casino winnings tax back. This is AFTER the claim is submitted. Any agency that tells you you could receive your US casino winnings tax back sooner is being misleading to get your business.

3. Agent of the IRS

Agents of the IRS are people or companies that are allowed to certify your ID, a requirement when claiming tax back from US casino winnings. This means one less chore for you when making your claim.

4. Excellent Track Record For Claim Approvals

The firm you use to claim tax back from your US casino winnings should boast at least a near perfect record when it comes to rightful claim approvals.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.03.26AM-e376b945aa4e4b7381f63b10e4de9cc2.png)

5. Owned and Operated by a Canadian Chartered Accountant

Tax Refund Casino Losses No Deposit

When claiming your tax back from US casino winnings, ensure the withholding tax specialist is a Canadian chartered accountant. This ensures your return is being handled by people with the appropriate expertise to be handling taxes. It will also provide you with insurance that your sensitive information will be handled professionally.

6. A Withholding Tax Industry Veteran

We are the longest standing withholding tax agency in the industry for a reason. Avoid leaving your refund in the hands of someone less experienced by choosing a withholding tax specialist who is tried, tested, and true.

Tax Refund Gambling Losses

7. Makes Casino Winnings Tax Refunds Easy

If you find you’re filling out multiple forms, your withholding tax professional is not earning their fee. The point to using a service when getting tax back from casino winnings is that they do all the leg work and make sure it’s done right.

RMS is the leading provider of withholding tax services for non-US residents. Learn why RMS is the right choice for claiming tax back from your US casino winnings and apply now for free.